Unlock your unclaimed money through UDGAM

In recent years, the government of India has introduced several initiatives to promote financial inclusion, streamline banking processes, and ensure the rightful owners reclaim their unclaimed assets. One such noteworthy step is the launch of the UDGAM (Unclaimed Deposits Gateway to Access Information) portal. This user-friendly platform empowers individuals to locate and claim unclaimed money lying dormant in bank accounts, often left behind by ancestors or forgotten over time.

Understanding the UDGAM Portal

The UDGAM portal, initiated by the Reserve Bank of India (RBI), serves as a centralized repository to assist individuals in tracking and reclaiming unclaimed bank deposits. These deposits include savings accounts, fixed deposits, and other financial instruments that have remained inactive for over ten years. The portal aims to reduce the staggering amount of unclaimed funds, ensuring these resources benefit their rightful owners.

Unclaimed deposits accrue due to various reasons, such as account holders’ demise, misplaced documents, or lack of awareness among heirs. By leveraging the UDGAM portal, individuals can overcome these hurdles, enhancing transparency and simplifying the claim process.

Why UDGAM Matters

Centralized Access: The portal consolidates data from multiple banks, providing a single window to search for unclaimed deposits.

Enhanced Transparency: It ensures transparency in the banking system by helping individuals trace and claim forgotten funds.

Ease of Use: With an intuitive interface, even non-tech-savvy individuals can navigate the platform.

National Interest: Unclaimed funds can be reintegrated into the economy, benefiting the financial ecosystem.

How to Search and Claim Unclaimed Deposits via UDGAM Portal

Here is a detailed, step-by-step guide to help you navigate the UDGAM portal and claim unclaimed money.

Step 1: Access the UDGAM Portal

Visit the official UDGAM portal at https://udgam.rbi.org.in/unclaimed-deposits/.

On the homepage, click on the “Search Unclaimed Deposits” button.

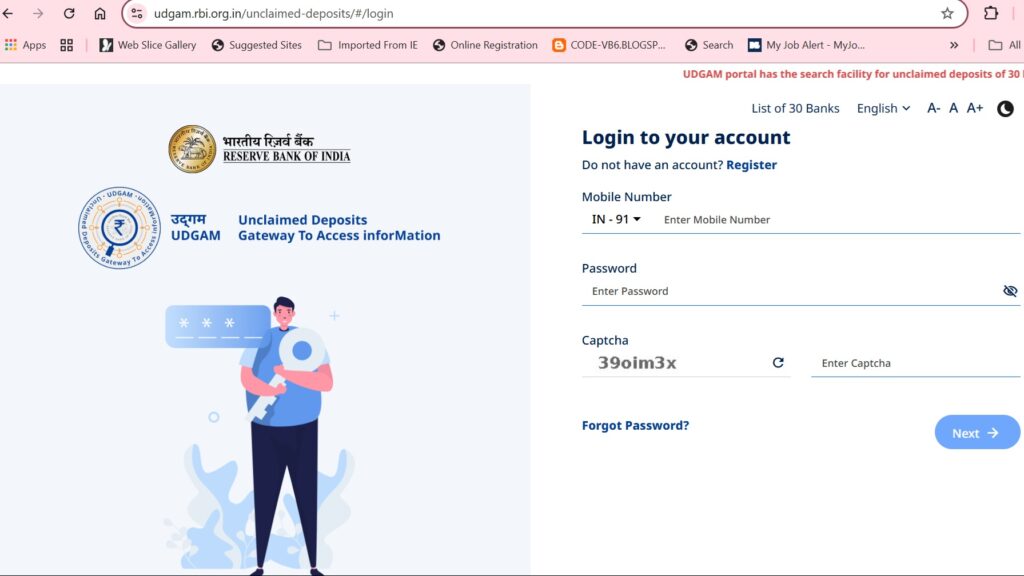

Step 2: Register and Login

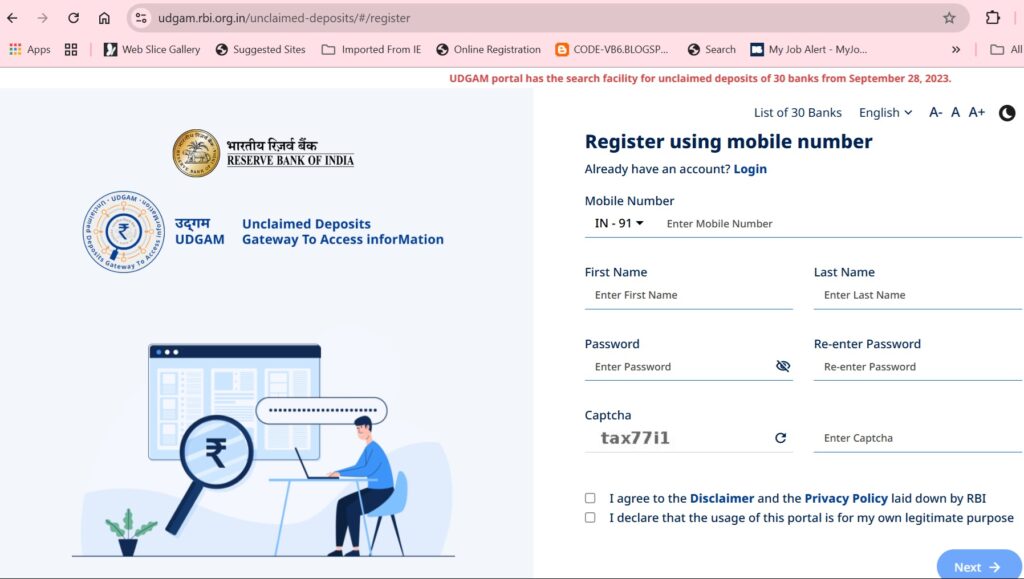

Registration: If you are a new user, click on “Register” to create an account.

Provide your full name, email address, and mobile number.

Set a strong password and complete the CAPTCHA verification.

Verify your account via the OTP sent to your registered mobile number or email.

Login: If you already have an account, enter your credentials and log in.

Step 3: Search for Unclaimed Deposits

On the dashboard, select the option to “Search Deposits.”

Enter the required details, including:

Account holder’s full name (as per bank records).

Any known bank account details, such as account number or IFSC code (optional).

Name of the bank where the account is held.

Complete the CAPTCHA and click “Search.”

The portal will display results matching your search criteria, including any unclaimed deposits linked to the provided details.

Step 4: Review the Search Results

Carefully review the search results for accounts that match your criteria.

Note down the details of the unclaimed deposit, such as account type, bank name, and approximate balance (if displayed).

Step 5: Initiate the Claim Process

Select the relevant deposit account from the search results.

Click on “Claim Deposit” to initiate the claim process.

Step 6: Submit Supporting Documents

To validate your claim, you will need to provide the following documents:

Proof of identity (e.g., Aadhaar card, PAN card, or passport).

Proof of relationship with the original account holder (e.g., legal heir certificate, death certificate, or will).

Proof of account ownership (if available, such as passbook or account statement).

Upload scanned copies of these documents through the portal.

Step 7: Track Your Claim

After submitting the claim, you will receive an acknowledgment receipt with a unique reference number.

Use this reference number to track the status of your claim through the portal.

Step 8: Verification and Disbursement

The bank will verify your claim and the supporting documents.

Upon successful verification, the unclaimed money will be transferred to your specified bank account.

You will be notified once the process is complete.

Tips for a Seamless Experience

Double-check all information and documents before submission to avoid delays.

Use the portal’s help section or contact customer support if you encounter issues.

Ensure you have a digital copy of all required documents for easy upload.

Key Takeaways

The UDGAM portal is a revolutionary initiative to help individuals reclaim unclaimed bank deposits.

The process is simple, transparent, and accessible to all.

By following the steps outlined above, you can efficiently locate and claim funds that rightfully belong to you or your family.

Disclaimer

This blog is intended for informational purposes only. While every effort has been made to ensure accuracy, users are advised to verify details and follow official guidelines provided by the UDGAM portal or the respective banks. The claim process and required documents may vary depending on the bank’s policies. Always consult a legal or financial expert for personalized advice. The author and publisher disclaim any liability for losses or damages incurred as a result of using this information.

More Information

For more information about UDGAM – Visit the following Reserve Bank Of India web page https://rbikehtahai.rbi.org.in/ud