CIBIL – “CREDIT INFORMATION BUREAU INDIA LIMITED”

In the intricate world of finance, few metrics hold the power to influence an individual’s financial journey like the CIBIL score. Often shrouded in mystery and confusion, understanding this three-digit number is crucial for anyone navigating the borrowing landscape. This extensive exploration aims to illuminate the CIBIL score in its entirety, delving into its origins, its intricacies, and its profound impact on financial well-being.

Unveiling the CIBIL Acronym:

CIBIL stands for Credit Information Bureau (India) Limited, the leading credit information company in India. Established in 2000, CIBIL functions as a repository, collecting and collating credit-related information on individuals and businesses across the country. This data forms the bedrock for generating the renowned CIBIL score, a numerical reflection of your creditworthiness.

Milestones of the journey of CIBIL:

Year 2000

TransUnion CIBIL Limited (formerly Credit Information Bureau (India) Limited) was incorporated based on recommendations made by the RBI Siddiqui Committee.

Year 2004

Credit bureau services are launched in India (Consumer Bureau).

Year 2006

Commercial bureau operations commenced.

Year 2007

CIBIL Score, India’s first generic risk scoring model for banks and financial institutions, was introduced.

Year 2010

Two firsts for the credit industry in India with the launch of:

CIBIL Detect: India’s first repository for information on high-risk activity.

CIBIL Mortgage Check: The first centralized database on mortgages in India.

Year 2011

CIBIL TransUnion Score is made available to individual consumers.

Year 2017

TransUnion acquired a 92.1% stake in CIBIL.

Decoding the Score Spectrum:

The CIBIL score is a three-digit number ranging from 300 to 900, with higher scores indicating a more favourable credit history and enhanced borrowing prospects. Here’s a breakdown of the score range:

Outstanding Score (750 – 900): This golden zone suggests responsible credit behaviour, prompt repayments, and minimal delinquencies. Individuals with such scores enjoy easy loan approvals, lower interest rates, and access to exclusive financial products.

Good Score (650 – 749): This range reflects a positive credit history, although minor lapses or limited credit usage might be present. While access to loans and credit cards remains favourable, interest rates might be slightly higher compared to the top tier.

Average Score (550 – 649): This zone indicates room for improvement in credit management. Missed payments or outstanding debts could be impacting the score. Loan approvals might be slower, and interest rates might be significantly higher.

Below Average Score (300 – 549): This range signifies significant credit challenges, suggesting frequent defaults, high debt levels, or insufficient credit history. Obtaining loans becomes difficult, and interest rates could be exorbitant.

Checking CIBIL in Free:

Hey 👋

Check your credit score for FREE & get customised recommendations.

Simply click the link below & follow these 3 steps 👇

STEP 1: Enter your Basic Details

STEP 2: Submit OTP

STEP 3: Enter Personal details

Start now & know your credit score 🎯 https://rb.gy/e466is

The Pillars of the Score:

Understanding the factors influencing your CIBIL score is crucial for strategic credit management. The key components driving the score include:

Payment History: This holds the greatest weight, accounting for around 35% of the score. Consistent and timely repayment of loans and credit card bills significantly bolsters your score.

Credit Utilization: This factor, accounting for around 30% of the score, measures the percentage of your credit limit you utilize. Maintaining low credit utilization ratios (ideally below 30%) demonstrates responsible credit usage.

Credit Mix: Having a diverse credit mix, including secured loans (e.g., mortgages) and unsecured loans (e.g., credit cards), can positively impact your score. Conversely, relying solely on credit cards might be detrimental.

Credit Enquiries: Frequent inquiries for new credit can negatively impact your score, as lenders might interpret it as excessive credit seeking behaviour.

Age of Credit Accounts: Longer credit history, with a track record of responsible borrowing, positively influences your score.

Beyond the Score: The CIBIL Report:

Your CIBIL score isn’t the only valuable element. The accompanying CIBIL report provides a comprehensive overview of your credit history, detailing:

- Personal information (name, address, etc.)

- Loan and credit card accounts held

- Credit limits and outstanding balances

- Payment history of each account, including delinquencies and defaults

- Public records related to bankruptcy or debt settlements

Analysing the CIBIL report enables you to identify discrepancies, rectify errors, and understand the factors influencing your score.

Unlocking Financial Independence: Leveraging the CIBIL Score:

A good CIBIL score isn’t just a number; it’s a key that unlocks numerous financial advantages:

- Improved Loan Access: A high score facilitates easier loan approvals, particularly for larger loan amounts.

- Lower Interest Rates: Lenders perceive individuals with high scores as reliable borrowers, offering them lower interest rates on loans and credit cards.

- Negotiation Power: A strong score gives you an upper hand when negotiating loan terms and interest rates.

- Exclusive Financial Products: Certain credit cards and other financial products are reserved for individuals with high CIBIL scores.

- Reduced Reliance on High-Interest Loans: Avoiding payday loans and other exorbitant interest schemes becomes easier with a good score.

Building and Maintaining a Stellar Score:

Building a strong CIBIL score requires conscious financial discipline and responsible credit management:

- Pay bills on time: This is the single most important factor influencing your score.

- Keep credit utilization low: Avoid maxing out your credit cards and maintain low balances relative to your credit limit.

- Diversify your credit mix: Consider applying for a secured loan like a mortgage to build

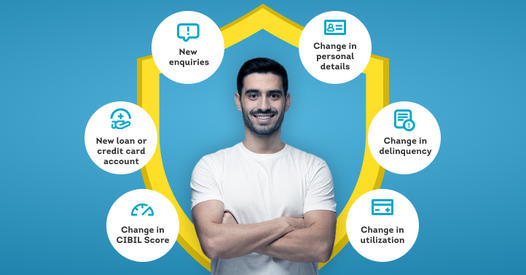

Safeguarding one’s Credit Profile:

Monitor your CIBIL Report regularly and flag any fraudulent activity: Checking your CIBIL Score and Report regularly is one of the best ways to monitor all your credit cards and loan accounts at once. The ‘accounts information’ section of your CIBIL Report is an overview of all the credit you have availed. Review this section and notify CIBIL in case of any accounts that you do not recognize as your own. You can also subscribe to CIBIL and avail of CIBIL Alerts to get notified of key changes in your CIBIL Score and Report. This will help you stay alert and tuned in to any suspicious activity that indicates credit fraud and identity theft.

CIBIL new Dashboard:

Explore the new CIBIL Dashboard for seamless navigation, financial tips, and personalized loan offers. Know more to Click – https://rb.gy/1pj49k